The Milton S. and Geraldine M. Goldstein Young Scientist Endowment

The Milton S. and Geraldine M. Goldstein Young Scientist Endowment

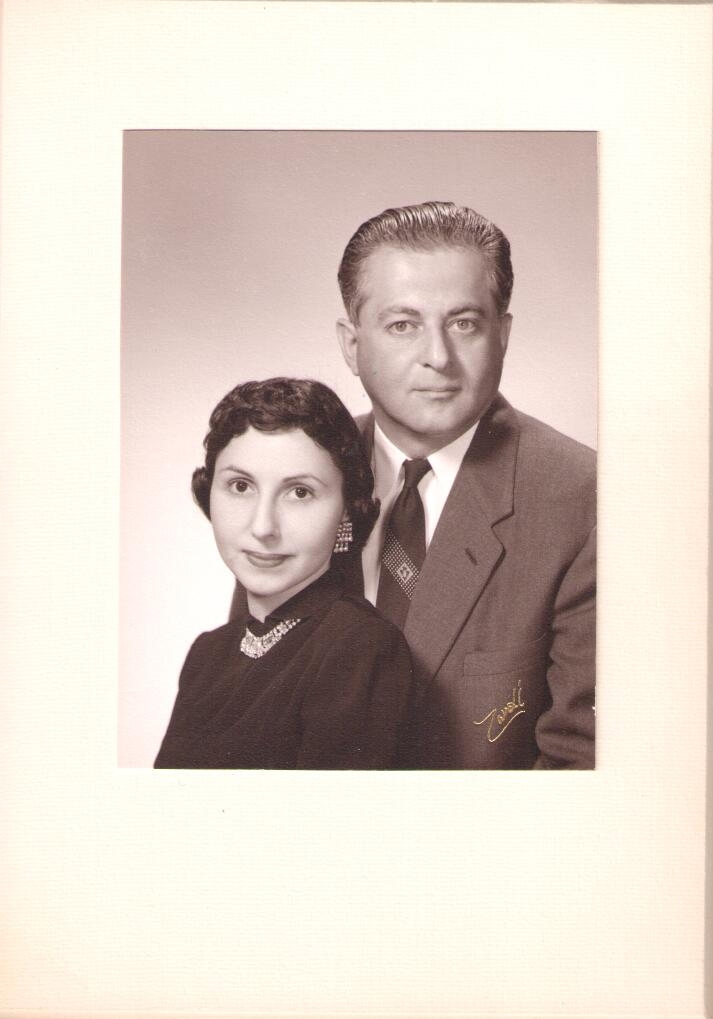

Texas Biomedical Research Institute is the beneficiary of a $4 million gift from Milton and Geraldine Goldstein to create an endowment that assists promising researchers above the postdoctoral level. From modest, hard-working beginnings to the establishment of an enduring legacy, the Goldsteins are a true American success story.

Milton Goldstein was a naturalized US citizen born in Poland in 1927. He moved to San Antonio with his family in 1933. From the age of 11, he worked along with his father at one of the first self-service department stores based in San Antonio. He always had strong ambitions as an entrepreneur, and after World War II, he built and managed small and medium apartment complexes in San Antonio. Having received a degree in journalism from the University of Texas, he aspired to share his life lessons. In 1992, he wrote Winner's Bible, his secrets for success in business and in life.

He met and married Geraldine in 1958. They lived in a 1950 vintage home in a modest, working class San Antonio neighborhood. They never had children but enjoyed short trips and spending time with their families and friends. They were frugal in both business and lifestyle. Milton's banker relates a story that Milton would regularly take out a short-term bank loan so that he could take the "2% net 10" discount then offered from construction suppliers. When their home was destroyed by fire, they moved into one of their apartments and rebuilt the home on the same foundation - only finishing the rooms of the house that they would use!

Milton and Geraldine always admired medical research and the vision of Texas Biomed's founder, Tom Slick. The Goldstein's incredible story will continue for generations, as their gift impacts the future of our community and our world, by providing young scientists with a helping hand early in their career.

"This gift comes at a time when young, aspiring researchers face an unusually difficult time getting their research funded. Level to flat funding of the National Institutes of Health, has made support of early-career research very challenging. In fact, a recent study shows that the average age of a scientist's first research funding award is now 42, which is unacceptable, in my opinion. I commend Milton and Geraldine Goldstein for their incredible foresight and generosity to help us address this challenge." Richard T. Schlosberg III, Chairman